401k Limit 2025 Married Filing Separately. Married couples filing jointly must decide how much they will contribute to their respective retirement accounts to avoid exceeding the irs contribution limit. In 2025, the income limit for the credit increased to $76,500 for married couples filing jointly, up from $73,000 in 2025.

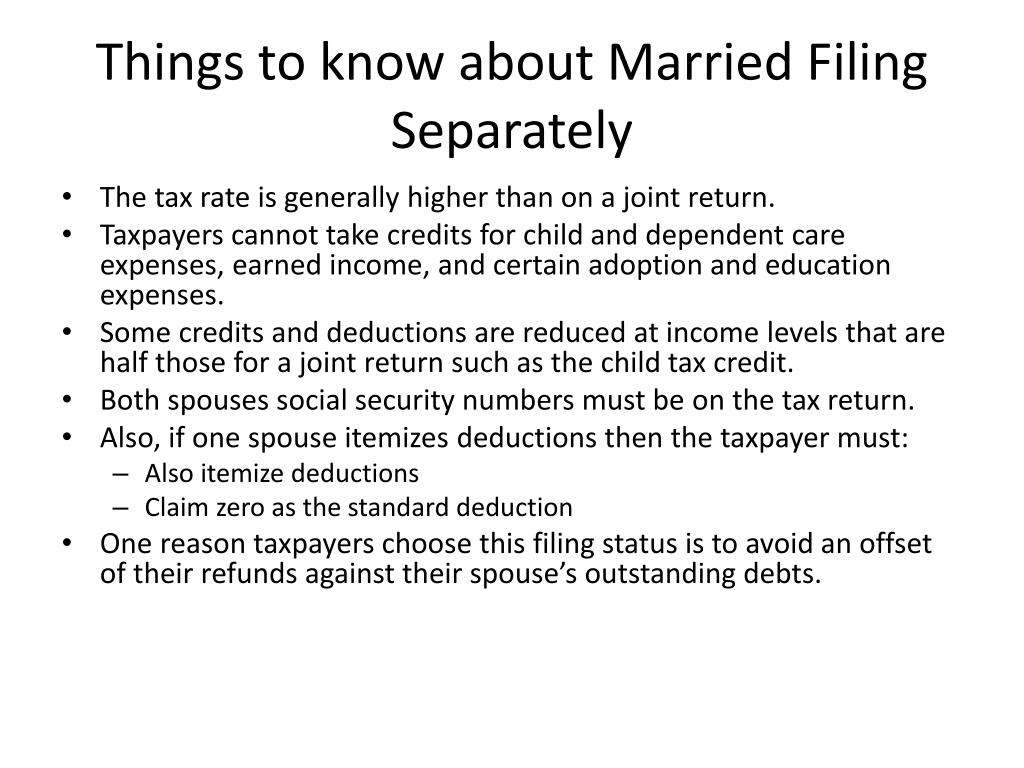

*married (filing separately) can use the limits for single individuals if they have not lived with their spouse in the past year. If they lived with their spouse at any point during the year, they can.

401k Limits 2025 Married Filing Separately Niki Teddie, The contribution limit for employees who have a 401 (k) plan is $23,000 in 2025.

Ira Contribution Limits 2025 Married Filing Separately Cassi Cynthie, Here are the contribution limits at a glance:

401k Contribution Limits 2025 Married Filing Separately Lucia Rivalee, A distribution from a roth 401(k), roth 403 (b) and.

401k Limits 2025 Married Filing Separately Niki Teddie, If you collectively earn between $123,000 and $143,000, you can take a partial deduction.

401k Limits 2025 Married Filing Separately Niki Teddie, Here are the contribution limits at a glance:

2025 401k Limits For Married Couples Rowe Wanids, Similar incremental changes were made to the limits for married filing jointly and married filing separately taxpayers.